how to find total manufacturing cost

As a small manufacturing business owner, you probably spend a lot of time thinking about pricing strategies and how to make your manufacturing process more efficient.

Before making decisions about inventory selling prices or changes to the manufacturing process, take a look at your total manufacturing cost. The calculation breaks down your manufacturing costs in a way that makes your expenses easy to analyze.

Overview: What are total manufacturing costs?

Total manufacturing costs refer to how much a company spent to produce its inventory in a given timeframe. The calculation is the sum of three product cost categories: direct material, direct labor, and manufacturing overhead.

Business owners need to know their total manufacturing costs. Once you understand the true cost of your manufacturing, you can more accurately account for inventory on your balance sheet and cost of goods sold on your income statement.

It's also an analysis tool. Splitting up your manufacturing costs into three buckets helps you see where you're spending too much and where you should invest more.

Total manufacturing costs are often conflated with the cost of goods manufactured (COGM). COGM counts only the cost of inventory that was finished and prepared for sale in the period. Total manufacturing costs include all costs incurred in the period, regardless of whether the product was completely finished.

How to calculate total manufacturing cost for your small business

As noted above, your total manufacturing cost is the total of three costs in a given accounting period: direct material, direct labor, and manufacturing overhead.

Total Manufacturing Cost = Direct Material + Direct Labor + Manufacturing Overhead

1. Direct material

Direct material is the cost of raw materials used in the manufacturing process which are inextricably linked to the final product. If your manufacturing company makes screws, the raw material is steel wire purchased from a supplier.

Raw materials that can't be traced to a specific product or manufacturing run are considered indirect material and are excluded from the direct material cost calculation.

For example, the cost of special oil used in a piece of manufacturing machinery is considered indirect material. Indirect costs get counted below in manufacturing overhead.

Spoilage, or raw material that can't be used in the final product, is to be expected. Unless there's an abnormal amount of spoilage, the cost of spoiled raw material gets included in your direct material calculation.

When calculating total manufacturing cost, we only care about the costs incurred in the accounting period. For businesses that use the accrual accounting method, direct material expenses are incurred when the raw material is used, not when it is purchased.

To calculate direct material, compare raw material at the beginning of the year and raw material purchases during the year with raw material left at the end of the year. The difference is how much direct material you used.

Direct Material = Beginning Direct Material Inventory + Direct Material Purchased During Period – Ending Direct Material Inventory

2. Direct labor

Direct labor refers to the wages of those working on manufacturing your company's products. Machine operators and assembly line workers are the most common types of direct labor workers.

For an employee's wages to count as direct labor, he or she must be working hands-on in the manufacturing process. Not all factory labor is direct labor.

Although they're essential to the manufacturing process, supervisors and cleaning staff don't count as direct labor workers. They're counted below in manufacturing overhead.

Check out our guide on the difference between direct and indirect labor.

Though there's no direct labor formula to follow, calculating direct labor is the most straightforward part of the calculation. Look at your payroll software and total the gross wages of your direct laborers for the year.

3. Manufacturing overhead

Manufacturing overhead means those manufacturing costs that aren't direct material or direct labor.

Common costs included in manufacturing overhead include:

- Depreciation expense

- Indirect labor costs for supervisory, quality assurance, and cleaning staff

- Factory utilities

- Factory rent or mortgage

- Factory supplies

Manufacturing overhead does not include expenses incurred outside of inventory production. Don't add in accounting and human resources staff salaries, for example.

Check out our guide to calculating manufacturing overhead.

4. Analysis

Finally, take a look at your total manufacturing cost and ask yourself a few questions:

- Based on my total manufacturing cost, is my selling price yielding my profit goal?

- Which expenses are higher than expected? Which are lower? Why?

- How can I streamline the manufacturing process for cost or time savings?

- How much inventory do I have at the end of the period? What are the carrying costs of holding on to this inventory?

Answering these questions is the starting point to improving your manufacturing efficiency.

Example of total manufacturing costs

Let's calculate the 2019 total manufacturing costs for Rose Burn, which opened in 2019 and makes and sells rose candles (no relation to actress Rose Byrne).

Start with direct materials. Rose Burn ordered its raw material from one supplier in January 2019.

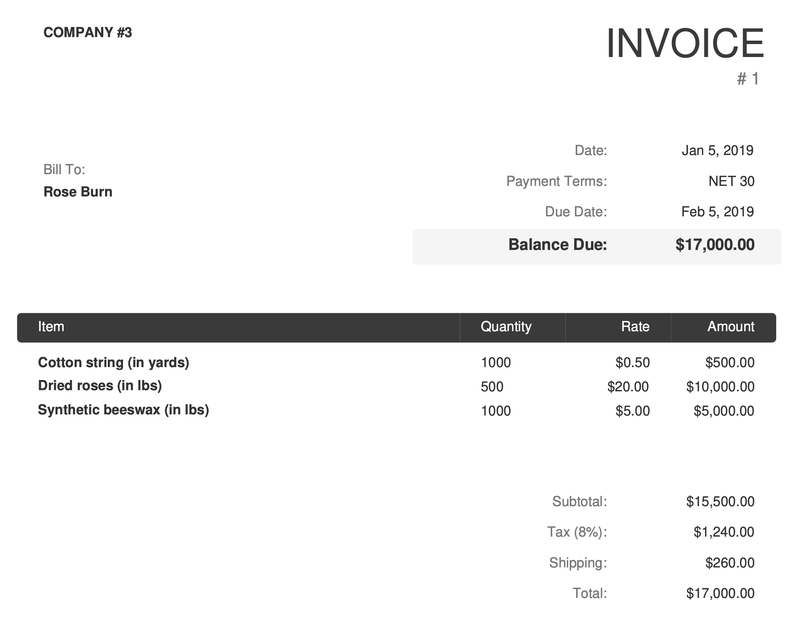

Direct material costs include tax and sometimes shipping costs. Source: invoice-generator.com.

The company used all of its direct materials during the year to make candles, so the entire $17,000 gets counted in the total manufacturing cost calculation. Note that tax gets included in direct material. Check our guide on shipping costs before you add freight costs.

Now, let's move onto direct labor. Rose Burn's payroll software shows that four people worked at the company last year. Their names, job titles, and gross pay are listed here:

Since Rose and Lily are not part of the candle-making process, their gross pay is excluded from the direct labor calculation. Direct labor is Tulip's and Daisy's gross pay, a total of $80,000.

We're almost done. Move onto manufacturing overhead. In this example, we've already come across one manufacturing overhead cost: Lily's $50,000 salary. As a manufacturing supervisor, she's not a direct laborer but is still integral to the manufacturing process.

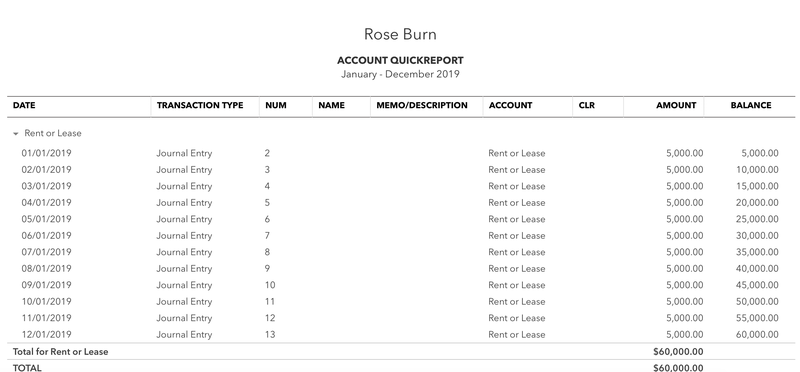

Next, we turn to Rose Burn's accounting software, which shows $60,000 in factory rent expense:

Factory rent is included in manufacturing overhead. Source: Intuit.

Rose Burn's accounting software shows the following other factory overhead costs:

- Factory utilities: $45,000

- Depreciation on factory equipment: $5,000

- Other supplies or equipment: $10,000

Rose Burn's manufacturing overhead is $170,000 ($50,000 manufacturing supervisor gross pay + $60,000 factory rent + $45,000 factory utilities + $5,000 depreciation + $10,000 supplies).

Add direct material ($17,000), direct labor ($80,000), and manufacturing overhead ($170,000) to arrive at the total manufacturing cost for the year, which is $205,000.

Rose Burn should take this information to the analysis table. How does the company's sales revenue compare to its total manufacturing costs? How much inventory is left at the end of the year? How can we optimize profit? Answer these questions while building next year's production budget.

Total manufacturing cost: It's a managerial must

Business owners and managers should keep an eye on their business's total manufacturing costs. It can provide insights for optimizing the manufacturing process.

how to find total manufacturing cost

Source: https://www.fool.com/the-blueprint/total-manufacturing-cost/

Posted by: plattbefoom.blogspot.com

0 Response to "how to find total manufacturing cost"

Post a Comment